Gambling Debt – Become Debt Free

A common consequence of gambling addiction is gambling debt. It sucks, but there are things you can do today to get back on your feet again. In fact, paying off your gambling debt can create a sense of pride, remove shame from things you’ve done and help restore your personal relationships. This guide explains key debt concepts, payment strategies, and support tools that can propel you to repay gambling debt faster.

A Success Story

#Success #DebtFree – Let’s begin by listening to the inspiring success story of Adrian, who paid off $50,000 in debt through dedication and strong motivation. Let’s kick this gambling debt guide off by listening to her story. #Video (2min video)

#NotAlone – You are not alone! Among problem gamblers in the US, more than 84% have gambling debt. The average debt generated is between $10,000-$50,000. Compulsive gamblers amid women gamblers have debt problems of an average of $15000. Only 15% of people with a gambling disorder are debt free. Let’s get you debt free!

#TakeResponsibility, #CreatePride, #ImportantStep – Dealing with your gambling debts is an important part of stopping gambling. Taking personal financial responsibility is key. Don’t let anyone else pay off your loans.

#Warning – You might experience mental pain when listing and compiling your debt. #BeAware that it can trigger some gambling urges. It might sound insane, but for a gambling-addicted brain, gambling has become the way (a solution) to relieve pain.

Gambling Debt – Financial Concepts

The more debt, the higher the interest rate is, the bigger part of the installment goes to paying interest, and the longer it’ll take to clear the debt.

Example:

How long will it take to pay off gambling debts of $15000 if the interest rate is 8% and my installments are $400/month?

In this example, the installments include the down payment and the interest rate. Let’s begin by converting the annual interest rate to a monthly rate: 8% per year is about 0.67% per month.

To determine how long it’ll take you to pay off your loan, you’ll need to calculate each month’s interest and subtract your payment to determine how much you still owe.

Let’s take a look at the first few months as an example:

- Start: $15000

- Month 1: ($15000 * 0.0067) + $15000 – $400 = $14,705

- Month 2: ($14705 * 0.0067) + $14705 – $400 = $14,408.33

- Month 3: ($14408.33 * 0.0067) + $14408.33 – $400 = $14,109.55

And so on…

Notice how the cost of the interest rate is decreasing for every money!

- Month 1: ($15000 * 0.0067) = $100.5

- Month 2: ($14705 * 0.0067) = $98.5

- Month 2: ($14408 * 0.0067) = $ 96.6

It means that you’ll pay off the loan faster and faster each month.

If you continue paying $400 monthly, it will take approximately 42 months (3.5 years) to fully pay off the $15000 gambling debt.

Key learning to pay off gambling debts faster:

- Minimize the interest rate. (Cost)

- Maximize the amount for each installment. (Paying off)

- Interest Rate: This is like a fee you pay for borrowing money. Say you borrow $100 from a bank, and the bank charges you a 5% interest rate. It means that you must pay them back the $100 you borrowed plus an extra $5 (5% of $100) for the service of lending you the money. Paying interest doesn’t make your credit card debts smaller. The interest rate is just the cost of getting the credit cards out. In general, people talk about interest rates on an annual basis (if nothing else is specified).

- Interest on Interest (Compound Interest): When you owe interest on both your original loan and the already added interest. For example, if you borrow $1000 at a 5% annual interest rate and don’t pay it back for two years, you’ll owe more than $1000 plus two years of simple interest. After the first year, you owe $1050 (original $1000 plus $50 interest). In the second year, you owe interest on the full $1050, not just the original $1000. So, you owe $1102.50 at the end of year two. The extra $2.50 is the interest on the first year’s interest.

- Installments: These are regular, usually monthly, payments you make to repay a larger sum of money over time. For example, when you buy a car or a house, you often take out a loan and pay it back in smaller amounts over several years. Each of these smaller monthly payments is called an installment. Each installment makes your debt smaller.

- Suspension of a Loan: This is like the creditor is pressing “pause” on your loan. You temporarily stop making payments, usually because you’re having financial difficulties. It’s a short-term break to help you regain financial health, not a cancellation—you still owe money.

- Calculate Monthly Interest Cost: To determine how much interest you’ll be charged monthly for a loan or credit card balance. Suppose you owe $1000 with an annual interest rate of 12%. First, you’d convert the annual interest rate to a monthly rate by dividing it by 12, so 12% per year becomes 1% per month. Then you’d multiply this rate by the amount you owe to determine the monthly interest. In this case, it would be $1000 * 1% = $10. So, your monthly interest cost would be $10.

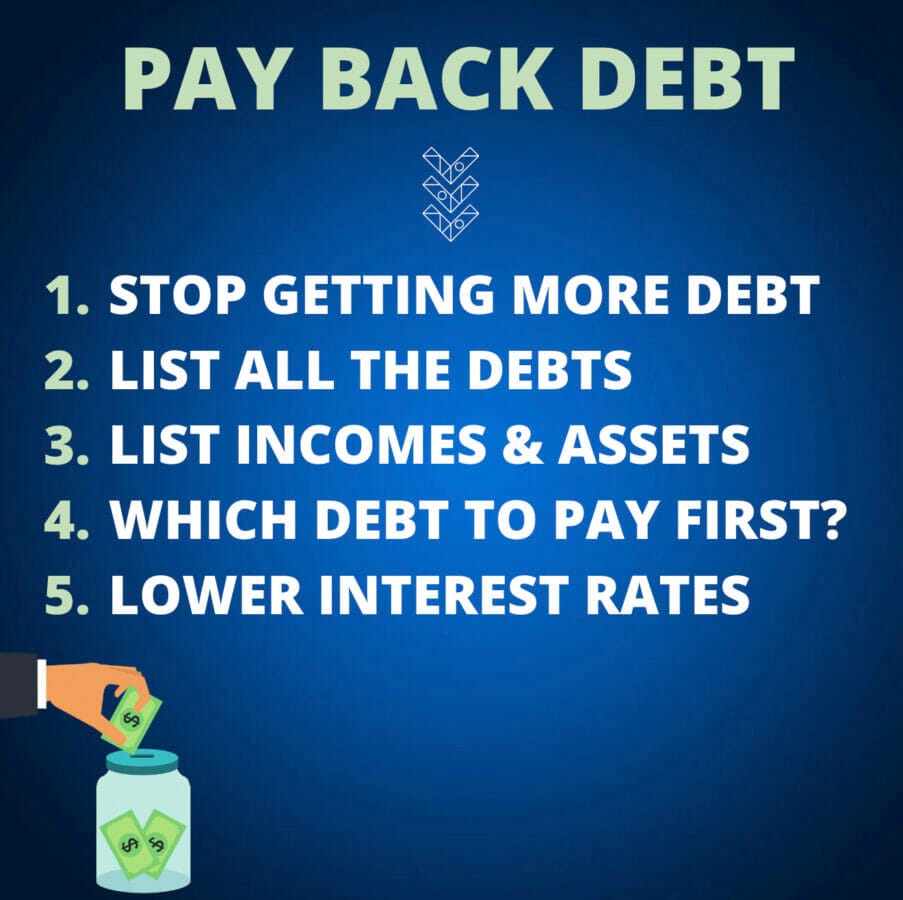

Steps to pay gambling debts

- Stop accumulating more debt (stop gambling, cut spending/ credit cards)

- List all the debts and personal loans (asses your financial situation)

- List your assets and incomes (your resources)

- Prioritize the debt (gambling debt strategies)

- What can you do to lower the interest rates and maximize the down payments?

Stop Gambling – No more debt

QuitGamble.com is an online platform for people who wants to stop gambling. We highly recommend you poke around on the site if you struggle with online gambling or land-based, and you’re most welcome to join our community with 3000+ members. In essence, if you want to quit gambling and understand that your gambling behavior does something for you. On QuitGamble, we help you:

- Understand what your gambling habits do for you

- Help you work with the underlying causes of the gambling addiction.

- Support and challenge you in the community

Here are a few guides we believe you’ll find interesting:

- How to stop gambling in 9 steps

- How to deal with gambling relapse

- What is gambling addiction?

- Block yourself from casinos.

We can’t get back the time spent gambling, and lost money is money lost. But stopping problem gambling is the first step to returning from financial ruin; get up your credit scores and improve your personal finances. Let’s put problem gambling in the past! Start by guide 9 step guide to stop gambling.

Assess your financial situation – List all debt

You’ve done a great job coming this far in this pay gambling debt guide! Now, it’s time to start listing all the debts you have. If you struggle to do it alone, you can ask someone to help you. Common types of gambling debt for a compulsive gambler are:

- Credit card debt

- Overdrawn bank accounts

- Payday loans / Test Loan

- Bank loans

- Loans from friends/family members

- Loan from loan sharks

- Cash advances

- Unsecured debts like medical, rent, utility bills

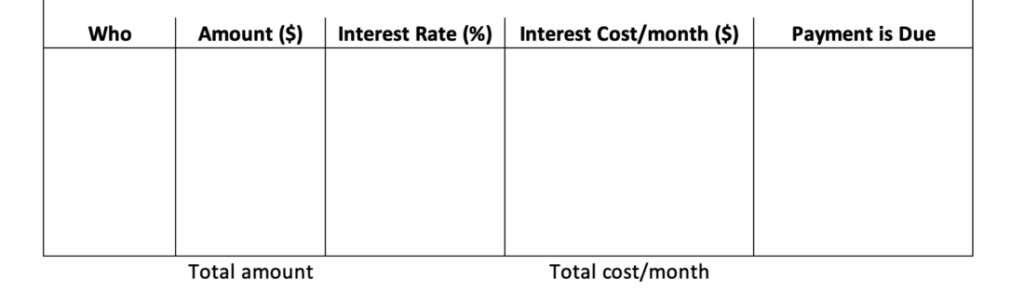

Make sure to list every person and organization you owe. List the amount, the interest rates, and the due date for the payment.

Besides unsecured debt, you might also have a home equity loan or have found ways to gamble with money from retirement funds or other personal finance. We suggest you list them too. These are too important to miss out on!

Some gambling debt might also come from illegal activities such as taking money from a spouse’s joint accounts, “stealing money at work,” and writing cheques without cover. In one study of members of Gamblers Anonymous, 63% have admitted to issuing checks that bounced due to insufficient funds, and more than 30% have confessed to theft from their places of employment. Add these amounts and people to the list as well!

Perhaps you’ve gambled for more than a decade, and there are some debts you’ve forgotten about. If you’re unsure you found all debts, you can do a credit report. Many companies online offer to make a credit report for you for a fee.

Here is a template you can download. In the template, you can automatically calculate your monthly cash flow and interest cost. Then you can see what monthly cash flow you need to have.

What income and resources do you have?

So far, we have talked about breaking free of gambling debt management and the problem of stopping accumulating new debt and listing everything you owe. Now it’s time to list the resources and means to start clearing the gambling debt. Make a list of the assets and income you have that you can use for the payment plan:

- Salary

- Anything you can sell?

People often focus on the negative qualities problem gamblers have. BUT, to sustain a gambling problem, a problem gambler is often very resourceful! We believe you are more resourceful than you give yourself credit for. The more money you can generate, the sooner you’ll be able to repay your loans and repair the negative consequences of gambling.

#GamblingNotAnOption, #Warning – Visit online gambling sites or sports betting isn’t debt management. We know gambling will be tempting – You, like many others, will think more than once that a big win would solve everything. BUT IT’S NOT TRUE! Just ask yourself what happened those times you won. Did you stop gambling then or continue until you had no money left? For someone with a gambling addiction, gambling has nothing to do with winning anymore. A problem gambler will just continue playing.

What can you do to generate more money?

- Take an extra shift?

- Do you have anything you can sell?

- Can you take a second job? Or do some freelance work?

- Any chance you can get a raise at your current job?

- What are you good at that can generate value for other people?

Tips – Lower your costs

Another way to improve your cash flow is to decrease your costs. Here are 11 things you can do to lower your living costs so you can spend a larger part of your income on paying off your gambling debt.

- Budget: Create and stick to a budget to understand your income and expenses clearly.

- Groceries: Cook at home more often and plan meals to reduce impulse buys.

- Utilities: Turn off lights when not in use, unplug electronics, and use energy-efficient appliances to lower utility bills.

- Transportation: Use public transportation, carpool, bike, or walk instead of driving alone.

- Shopping: Buy items in bulk, on sale, or secondhand. Avoid impulse purchases.

- Subscriptions: Cancel unused memberships and subscriptions like gym, streaming services, magazines, etc.

- Entertainment: Enjoy free or low-cost entertainment such as parks, libraries, or local community events.

- Housing: Consider getting a roommate or downsizing to a smaller living space.

- Insurance: Shop around for the best health, home, and car insurance rates.

- Cell Phone Plan: Switch to a cheaper cell phone plan or use family plans.

- DIY: Do your own basic home and car maintenance.

- Health: Practice preventive health care to avoid high medical bills in the future.

- Clothing: Buy classic pieces that mix and match easily and can last longer.

Payment Strategies – Debt management plan

Let’s pay that gambling debt! Later, we’ll discuss debt relief options and possible gambling debt relief and settlement, but first, let’s go over some payment plan strategies to pay off your personal loans. Motivation to stick to your plan and budget is key, so we suggest a few strategies. Choose the one that works best for you.

The Avalanche method – Start with the most expensive debt

When you assessed your financial situation above, you listed all gambling debt. In the Avalanche method, you sort the debt by interest rates starting with the highest. The advantage of this method is that you quickly lower the overall cost of your debt problems. With a fixed monthly payment, a larger portion of the payment goes to paying off the debts every month. Remember, paying the costs of the debt doesn’t make the debt smaller. So seeing the cost goes down can be a huge boost of motivation to continue.

The Snowball Method – Start clearing the smallest debt

The financial guru Dave Ramsey is a big advocate of the Snowball Method to escape gambling debt. While the logic says to follow the avalanche method and begin the most expensive debts, Dave Ramsey believes in small rapid wins to get started. In the Snowball method, you sort the debt due to size. You list the smallest gambling debt first. The benefit of the Snowball method is that it can clear your first, second, and third sports betting debt relatively fast. You may pay off the first small loan directly by organizing your income and resources. The Snowball method is a good choice to stimulate your motivation.

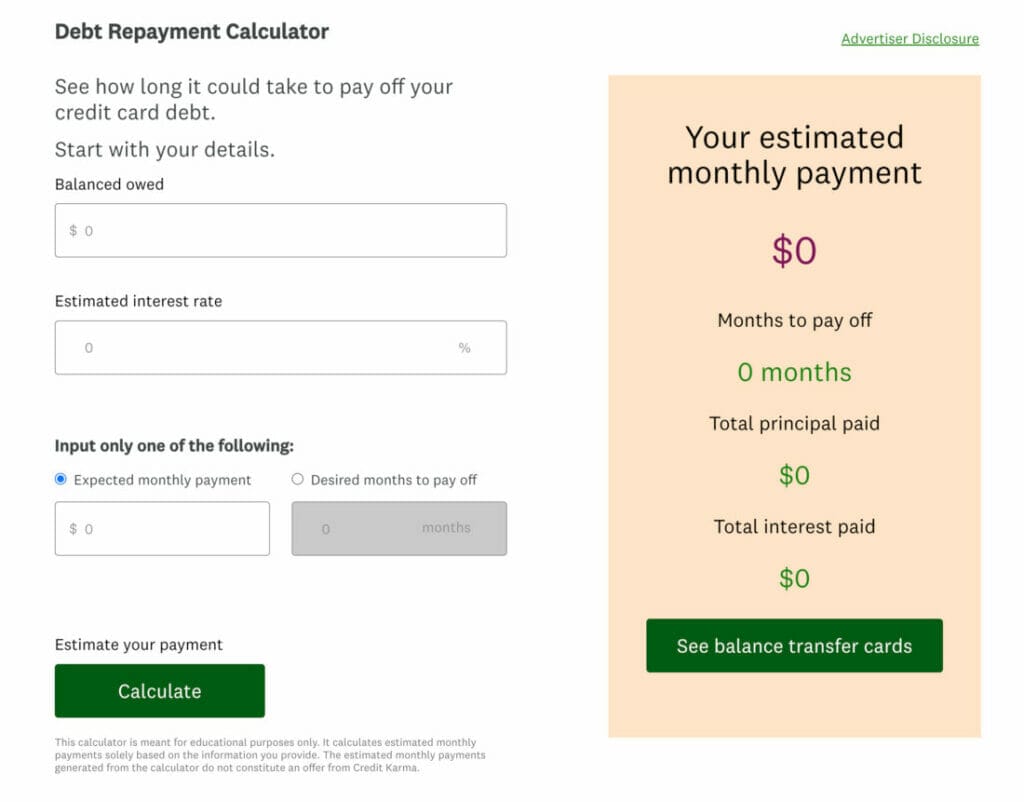

Debt Calculator

- How long time become gambling debt free?

- How much is the monthly cost of debt?

- How much to pay/month to clear $40K in debt in 5 years?

Master tips – Bulletproofing your payment plan

- Celebrate every paid debt! Create a ritual or ceremony to praise yourself for clearing a debt on your list. Use your imagination. Some people enjoy ripping the debt document in half; others set it on fire or drop it in a special paper bin. Celebrate each paid-off gambling debt as a victory, something to be proud of. You’re taking responsibility for the financial consequences of gambling problems and getting one step closer to gambling debt-free.

- Stay on top of current bills! Before starting the snowball or avalanche method, you must be current on the bills. Make sure to pay utility bills, home equity loans, and credit cards. (We recommend not using credit cards at all from now on.) By staying on top of your current bills, you’ll not accumulate more debt, and it’s easier to focus on your payment plan.

- Pay more than once per month. Some pay one fixed monthly payment, and it’s good to ensure you pay at least once a month. But, if you get an opportunity to pay more money during the month, don’t hesitate to do so. It’s easy to get itchy fingers to buy something for the extra money. By creating a habit of paying more than once monthly. It’s easier to resist spending the extra money as soon as you make it. WOW, be proud of yourself for each extra payment you make!

- Pay more than the minimum. You can reduce your debt and save on interest charges by consistently paying more than the minimum required monthly. The idea is to make additional payments regularly, which helps to speed up the loan repayment process.

- Buffer for Unexpected Expenses. Set aside some money for an emergency fund. The fund can cover unexpected expenses like a medical bill or car breakdown.

Family member – Dos and Don’ts

In the guide on protecting yourself from a gambling spouse, we advise how to protect your finances when you live with a gambling addiction. One tip is to remove access to any joint savings accounts. There are some things to think about if you want to help someone with a gambling disorder deal with their debt. Here are some dos and don’ts:

- DO – Cheer them on and be there if they need someone to talk to.

- DO – Help them understand financial terms

- DO – Help explore debt settlement and gambling debt relief options

- DO – Help consolidate loans to decrease the interest rate.

- DO – If you want, you can offer to take financial control by getting the person with a gambling problem salary to your account. That way, you can ensure the monthly debt payments are made first.

- DO – Help them get find nonprofit credit counseling agencies to get support.

- DO – Explore options to help them beat their gambling problem. For example, join them on QuitGamble.com or encourage them to visit support groups like Gamblers Anonymous.

- DON’T – Never pay their debts! Don’t give them any gambling debt relief in order to be helpful. They must pay for themselves. Taking responsibility for their compulsive gambling actions is critical for them to stop gambling.

- DON’T – Never lend them money. Even if it sounds like a good idea, you have a good intention. Lending money to problem gamblers is a way to enable their problem gambling.

Other Gambling debt relief alternatives

In some cases, the mountain of debt is too big. When the debt costs are higher than how much you can pay each month, you need to consider other options, including debt settlement, gambling addiction and bankruptcy, and getting debt suspension. These are ways to decrease debts by talking with your lenders.

What is Gambling Debt Settlement?

Debt settlement is a process where you negotiate with your creditors to pay a lump sum less than the total amount you owe. It can help you clear your debt faster and for less money. However, it can hurt your credit score, lead to collector calls, and potential tax implications as forgiven debt may be considered income. It’s advisable to consider all options, including debt counseling or a debt management plan or plans, and consult a financial advisor before proceeding with debt settlements.

What is Gambling Debt Suspension?

Debt suspension temporarily halts your loan repayments, providing relief during financial hardship. However, interest may still accumulate during this pause. Always consult your lender for their specific terms.

Debt suspension is an alternative to debt settlements. It could give you some extra time to get back on your feet by paying off other more expensive debts. To improve your chances of getting a settlement or suspension, you must actively work on your gambling problem. We highly recommend you read the gambling relapse guide, especially the part about self-empathy. It’ll help you understand what gambling does for you and why you have acted the way you’ve done.

Gambling Addiction and Bankruptcy

The last resort is to file for bankruptcy. Bankruptcy aids individuals unable to settle their debts by offering a new beginning. This is achieved by selling off assets to cover the debts or formulating a repayment plan. One American study showed that 20% of gambling addicts had filed for bankruptcy due to gambling.

Gambling debt help providers

No gambling provider, gambling commission, American Gaming Association, or any online gambling companies licensed will offer help to recover from sports betting debt. But there is support out there.

- QuitGamble.com: The main focus of QuitGamble.com is to help people who want to stop gambling. In the community, you’ll find 1000s of members who struggle with debt. Gambling addiction can be lonely, but you’re not alone anymore. Feel free to join and ask questions about how other people have dealt with their debt.

- Credit Counseling Agencies: Some of these organizations can provide free advice on managing your money and debts and help you develop a budget. They can also offer free educational materials and workshops.

- A Support Group: Groups like Gamblers Anonymous provide peer support from others dealing with the same issues.

- Financial Advisors: They can help create a plan to pay down your debt and manage your finances.

- Legal Aid: If your debt has led to legal issues, you may want to consult with a lawyer.

Let’s break free of your gambling debt! List your debt, choose a payment strategy, and start working on it. You can do this! If you need support on the way, you’re welcome to join us at QuitGamble.com.